Economic, Social, Governance (ESG) priorities are essential for organizations attracting new investment. But a lot of ESG efforts stumble when it comes time to show high-quality data that investors can trust. The Internet of Things can fix that.

According to a study commissioned by U.S. asset management giant Capital Group and conducted by CoreData Research, 2022 was the year that ESG goals became a widespread feature of corporate investment strategies worldwide.

Capital Group found ESG adoption reached an enormous 89% in 2022, a figure that aligns with similar reports from PwC and Morningstar.

At the same time, the Capital Group study identified that many investors saw a lack of consistent and reliable data on ESG (53%) and a lack of data standardization (70%) were barriers to effective analysis and implementation of ESG into their investment decisions.

The study also noted that nearly 40% of investors agreed that product innovation was holding back further ESG adoption.

For CEOs and executive decision-makers who are committed to ESG goals – for both the good of the planet, their bottom line and how investors perceive them, the Internet of Things (IoT) can deliver: it is possible to take steps to minimize waste, limit pollution and carbon emissions, improve employee satisfaction and increase operational efficiency and cost savings. IoT makes it easier to collect, aggregate and subsequently report data for the benefit of investors.

Let’s get into how you can do that.

Most ESG ratings rely on external data reporting — and that’s a problem

Despite being central to most sustainability policies and investor relations, ESG data collection is rarely easy, especially if your organization has diverse assets. This isn’t helped by the fact that, at the moment, there is no consensus on what the most important ESG metrics are.

Part of the reason for this is the diversity of the market itself – no one set of metrics is optimal for all businesses. ESG data reporting for a software development firm will look very different from that of a water utility company. We need to weigh factors differently on a sector-by-sector basis.

This has the understandable tendency of encouraging organizations to prioritize those metrics that are the easiest to measure and which paint the organization in the best light possible. Case in point, The Capital Group study we mentioned noted that when looking into the weighting of environmental, social, and governance factors, environmental factors dominate, which has been raised as a concern by some investors.

There is nothing wrong with this, but savvy investors are becoming more discerning – but the onus is still on the organizations themselves to gather and create external reports to be considered for more favorable ESG ratings.

Example: MSCI ESG ratings & real estate development

For example, let’s look at Morgan Stanley Capital Investment (MSCI)’s ESG Ratings. MSCI is a trusted, well-established name in investment. It uses a relatively transparent, rules-based methodology for calculating its ESG ratings.

MSCI relies entirely on publicly available data when calculating its ratings. There are no explicit requirements for an organization to receive a rating from them. Their ratings focus on a singular purpose: “to measure a company’s resilience to financially material environmental, societal and governance risks.”

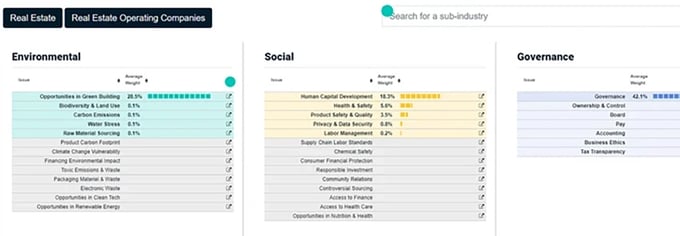

Using their Materiality Mapping tool and using the real estate operating sector as an example, we can get a sense of how certain ESG factors contribute to a rating MSCI might give.

The results are pretty easy to understand. The top-weighted factors are:

- Governance (42.1%): Broadly covering the structure, transparency and ethics of the company.

- Opportunities in Green Building (28.5%): assessing resource consumption and environmental performance of real estate assets.

- Human Capital Development (18.3%): What they do to attract, retain, and develop their workforce.

- Health & Safety (5.6%): How they manage workplace safety and the health of their employees.

To achieve a top ESG rating from MSCI (AA or AAA), the company must show “ strong and/or improving management” in these relevant issue areas.

MSCI, and other rating authorities like them, are paying particular attention to trends and how they perform vs. their industry peers, meaning it’s insufficient to commit to one-off efforts – the top-rated companies have been consistently improving and reporting on these improvements over several years.

The good news is that whether you are leading a company already on its way to improving its ESG practices or you’re only getting started now, IoT technologies can help you create and maintain long-term momentum for your business in a number of these key ESG factors.

IoT builds bridges to better ESG outcomes

Efficiency gains and optimization have long been core value propositions of many IoT products – and while they are not frequently marketed in such a specific way, precise and reliable data collection is a necessary component of this proposition.

From its earliest days, the Internet of Things has always been about making small, incremental improvements that, over time, help you make better decisions and ultimately produce better long-term outcomes for your organization. This is coincidentally what ESG rating authorities like MSCI are looking for when assessing corporate risk profiles and performance.

To use our previous example of real estate operations, how might a company in this sector use IoT technologies to improve outcomes that are considered important using MSCI’s rating methodology?

While the most heavily weighted category, Governance, isn’t an area where IoT has application (the category largely centers around decisions about people and how your corporate structure is configured), IoT does have numerous applications.

In assessing this factor, MSCI is looking for evidence that the organization is actively working towards “green building commitments or targets,” including efforts related to new real estate developments and renovating or retrofitting existing buildings. They also consider how real estate operators work with tenants to improve and maintain environmental performance.

To an extent, MSCI seems to rely on the external indicators of both “green certifications” – for example, DGNB, BREEAM, LEED – and regulatory standards of the country where the building is located. We know that to achieve these certifications, organizations have achieved the necessary energy efficiency and environmental requirements with the use of IoT systems, including:

- Smart lighting: including sensors and controllers that can monitor energy usage and optimize according to usage patterns.

- Automated utility management: including systems that can monitor, control, and regulate water, energy and gas consumption within a building.

- HVAC automation: including systems monitoring and optimizing heating, cooling, and air quality in line depending on when certain rooms are in use or at certain times of the day.

This category goes beyond the superficial elements of an organization’s ability to attract and retain talent and also examines what an organization is doing to listen and respond to the needs of its workforce and monitor employee satisfaction.

For a real estate operator, this likely would encompass not just the well-being of its employees – administrative staff, facilities managers, construction and repair professionals – as well as the well-being of its tenants.

A range of IoT and connected devices can help real estate operators monitor the well-being of their tenants and employees.

For example, using a combination of occupancy sensors and employee input through their company phone or tablet, you could monitor how much time a facilities manager needs to get between work sites, which, along with direct input from them directly, could be used to optimize or reprioritize work so they don’t feel like they constantly have to walk somewhere for their entire working day.

This includes issues you’d typically associate with this factor – workplace accidents, risk penalties and litigation and the impact those things have on your reputation as a company.

For MSCI, there is a significant focus on trends and coverage when assessing this factor:

- Is the organization meeting health & safety targets year-over-year, and are they trending positively from a baseline year?

- Is there a track record of achieving targets?

No organization is perfect – accidents will happen. The point is what is being done to make them less likely.

IoT technologies are perfectly positioned to help in building such a track record. Networked systems, including cameras, lighting, and applications, can be managed and monitored. Using machine learning, you can keep careful track of workplace safety.

What is more, primarily related to real estate operations: these systems can be used for predictive maintenance – using a combination of machine learning, data collection and monitoring of structures and systems to determine when things should be repaired or replaced.

Start your journey toward your ESG goals with Severn WLD

As an example, using the technology we use at LAIIER, our sensor products can be used as an integral part of a system that monitors the walls and roofs of buildings, which can be used to either predict or give early warning that a dangerous water leak is occurring, long before it causes significant damage or compromises anyone’s safety.

To learn more, visit our Severn WLD page and start reaching your ESG goals with the power of the Internet of Things.